How Inflation Really Affects Your Savings in the UK

Ever feel like your money just doesn't stretch as far as it used to? You're not imagining it. Inflation isn't just a scary word in the news; it's a sneaky force that quietly erodes the real value of your hard-earned savings. Even if the number in your bank account stays exactly the same, the actual buying power of that money can shrink year after year, especially if prices are climbing faster than your interest earnings.

Here in the UK, inflation has been stubbornly sitting above the Bank of England's 2% target, leaving many of us wondering if our savings are actually losing ground. And the numbers back that up: a recent analysis by Fidelity revealed that British savers collectively lost a staggering £17.6 billion in real value in 2025. That's like losing almost £122 of your purchasing power per adult while you were sleeping – simply because the interest you earned couldn't keep up with rising prices.

This guide is here to help. We'll break down exactly how inflation impacts your savings, give you clear UK-specific examples and calculations, and most importantly, arm you with practical steps you can take to protect your money and make it work harder for you.

What Is Inflation and Why It Matters to Savers

You hear the word “inflation” a lot, but what does it actually mean for your money? In simple terms, inflation is the rate at which the prices of everyday things – from your weekly food shop to your energy bills – go up over time.

Imagine it like this: if inflation is, say, 3%, it means that the same amount of money you have today will buy you roughly 3% less next year. Your cash isn’t literally disappearing, but its buying power is shrinking.

Let’s use a simple example:

- If your favourite loaf of bread costs £1 right now, with 3% inflation, you might find yourself paying £1.03 for that same loaf next year.

- Now, here’s the crucial bit for savers: If your bank account is only giving you, say, 1% interest on your savings during that same year, you’re actually going backwards. Even though you’ve earned a little bit of interest, prices have risen much faster. So, in “real terms” – meaning what your money can actually buy – your savings have lost value. It’s like running on a treadmill that’s going faster than you are!

This is why understanding inflation is so vital for anyone trying to grow or even just protect their savings.

Your Savings vs. UK Inflation

It’s one thing to talk about inflation, but it really hits home when you see how it impacts your actual money. Let’s look at a few common scenarios for UK savers, assuming inflation is sitting at 3.4% – a figure we’ve seen recently.

Imagine you have £10,000 saved up. Here’s what could happen to its real value after a year, depending on where it’s sitting:

| Scenario | Starting Amount | Inflation | Interest Rate | What Happens to Your Buying Power |

|---|---|---|---|---|

| Basic Savings Account | £10,000 | 3.4% | 1.94% | You lose about £146 |

| Fixed-Rate Savings | £10,000 | 3.4% | 3.56% | You gain a tiny £16 |

| No Savings Interest | £10,000 | 3.4% | 0% | You lose a significant £340 |

Let’s break down what these numbers really mean for you:

- The “Basic Savings Account” Reality: If your £10,000 is sitting in a typical easy-access account earning around 1.94% (which is a common rate for many UK accounts), you might think you’re earning money. But with inflation at 3.4%, your interest earnings aren’t keeping pace with rising prices. In real terms, your £10,000 can now buy about £146 less than it could a year ago. It’s like running on a treadmill that’s going faster than you are!

- The “Fixed-Rate Savings” Effort: If you’ve been savvy and locked your money into a fixed-rate account offering a slightly better 3.56%, you’re just about breaking even. You’d see a tiny real gain of around £16 in purchasing power. It’s a small win, but it shows you need to actively seek out better rates just to stay ahead.

- The “No Savings Interest” Hit: This is the starkest example. If your money is in an account earning no interest at all (like some current accounts), that 3.4% inflation means your £10,000 can now only buy what £9,660 could a year ago. You’ve effectively lost £340 in purchasing power without doing anything!

The clear takeaway here is critical for every saver: if the interest rate on your savings is lower than the rate of inflation, your money is quietly losing value. You’re earning less than prices are rising, and that means your hard-earned cash is buying you less and less each year.

How Inflation Quietly Shrinks Your Money Over Time

It’s easy to dismiss inflation when it’s just a few percent, but its real danger lies in its cumulative effect. Over months and years, it can seriously erode what your money can actually buy.

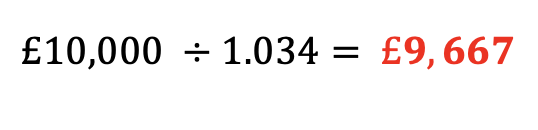

Let’s imagine you have £10,000 tucked away today, and for simplicity, let’s assume inflation consistently hovers around 3.4% each year, and your savings earn no interest (or less than inflation).

Here’s how that £10,000’s buying power would change:

After just 1 year

That £10,000 would only be able to buy what £9,667 could have bought you today. You've effectively lost £333 in purchasing power.

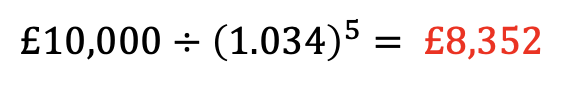

Fast Forward 5 Years

If inflation stays at 3.4% and your money isn't working hard enough to beat it, your original £10,000 would only have the buying power of approximately £8,352 in today's money. That's a staggering loss of £1,648 in what you can actually purchase!

So, even if the number on your bank statement still proudly says “£10,000,” the reality is that its power to buy goods and services has significantly diminished. This is why simply holding onto cash, especially when inflation is high, can be a costly mistake for your long-term financial health.

Why So Many UK Savings Accounts Just Can't Keep Up

So, we’ve seen how inflation can quietly chip away at your money. But why do so many of our savings accounts seem to struggle to keep pace?

It’s a frustrating reality for many in the UK. A recent analysis by Trustnet really highlighted this problem: when inflation climbed to around 3.8%, more than half of all available UK savings accounts simply weren’t offering interest rates high enough to beat it.

Think about that for a moment: if you had your money in one of those accounts, you were effectively losing purchasing power, even though you were technically earning interest. Your money was shrinking in real terms.

The biggest culprit? Often, it’s the easy-access accounts that many of us prefer. We love them because they offer flexibility – you can get to your money whenever you need it. However, this convenience often comes at a cost: these accounts typically offer lower interest rates. And when inflation is high, those lower rates mean your money is almost certainly losing value, even if it feels safe and accessible. It’s a tough trade-off between flexibility and actually growing your wealth.

The Hard Truth: £7 Billion Lost 'While You Slept'

This isn’t just theory; it’s a very real problem for UK households. A significant analysis by Fidelity International revealed that during 2025, British households collectively lost a staggering £7 billion in purchasing power. And the kicker? This happened simply because inflation was higher than the average interest earned on their savings.

To be clear, your bank balance didn’t suddenly drop by £7 billion. What did happen is that the money in those accounts could buy £7 billion less than it could the year before. It’s like waking up to find your shopping basket is suddenly smaller, even though you have the same amount of cash in your hand.

Inflation and Interest Rates: The Bank of England's Tricky Dance

So, who’s in charge of this? The Bank of England plays a crucial role, using interest rates as its main tool to try and keep inflation in check. When they raise interest rates, it can be good news for savers, as your money potentially earns more. However, it’s a delicate balancing act, as higher rates can also slow down the economy and make borrowing more expensive for everyone.

The recent ups and downs in inflation and interest rates have made it incredibly difficult for savers to predict what their money will be worth. The result? Many of us are left with “negative real returns” – meaning our savings are actually losing value after inflation, despite earning some interest.

What UK Savers Can Do: Practical Steps to Protect Your Money

It’s easy to feel helpless against inflation, but you’re not! There are concrete steps you can take right now to protect your hard-earned cash and make it work harder for you.

Shop Around for Inflation-Beating Accounts

Don't just stick with your current bank out of habit. Some savings accounts and fixed-rate bonds do offer rates that can beat inflation. As of late 2025, there were over 900 UK accounts offering rates above inflation, including easy-access and notice accounts. It pays to compare!

Make the Most of Cash ISAs

These are your secret weapon against tax. Cash ISAs allow you to earn interest completely tax-free. While they might not always beat inflation, any returns you do get are all yours, making them a much more efficient choice than taxable alternatives.

Consider Fixed or Longer-Term Options

If you have money you don't need immediate access to, locking it away for a set period (like 1, 2, or 5 years) in a fixed-rate bond or ISA often gets you a significantly better interest rate. The trade-off is that you can't touch the money during that time without penalties.

Diversify Your Savings

Don't put all your eggs in one basket. It's smart to keep some easily accessible cash for emergencies, but consider spreading the rest across different types of savings tools. This could mean a mix of short-term fixed products, notice accounts, or even exploring investments if you're comfortable with the associated risks. This balances your need for access with the desire for better returns.

Real-Life Scenarios: How Your Choices Make a Difference

Let’s look at two common situations to see how these decisions play out:

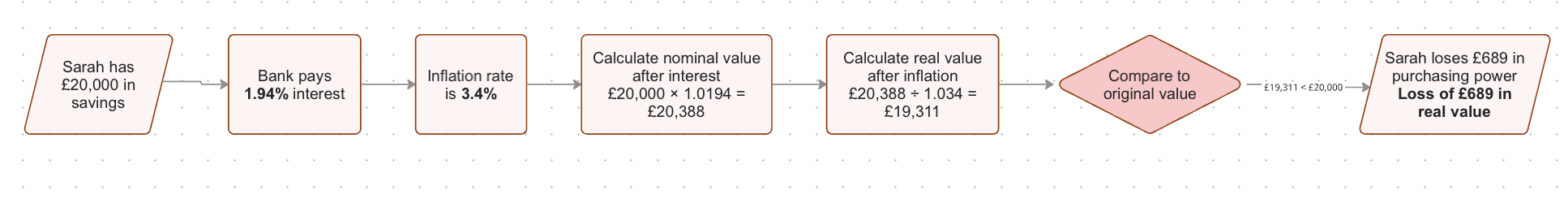

Sarah Sticks with a Basic Account

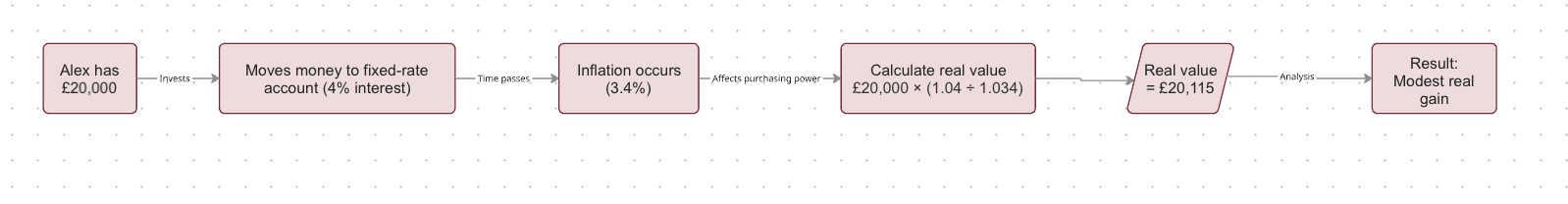

Alex Gets Savvy and Moves to a Better Account

FAQ — Common Questions People Ask

What does it mean when inflation is higher than my savings interest?

Do savings accounts ever beat inflation?

Should I withdraw savings because of inflation?

Q4: How often does inflation affect savings?

Can investing protect savings from inflation?

Don't Let Inflation Steal Your Savings' Shine

So, there you have it. Inflation isn’t just a distant economic concept; it’s a quiet force that can steadily chip away at the buying power of your hard-earned savings. In today’s UK landscape, with many traditional savings accounts simply not keeping pace, it means a lot of us are unknowingly losing real value over time.

But here’s the good news: you’re not powerless. By understanding how inflation works and, crucially, by being proactive with your savings strategy – whether that’s by seeking out higher-yield accounts, considering fixed-term products, or exploring tax-efficient options – you can actively protect your money from this silent erosion. It’s about making smarter, more informed financial decisions that truly benefit you.

Think of this guide as your ongoing companion in the fight against inflation.